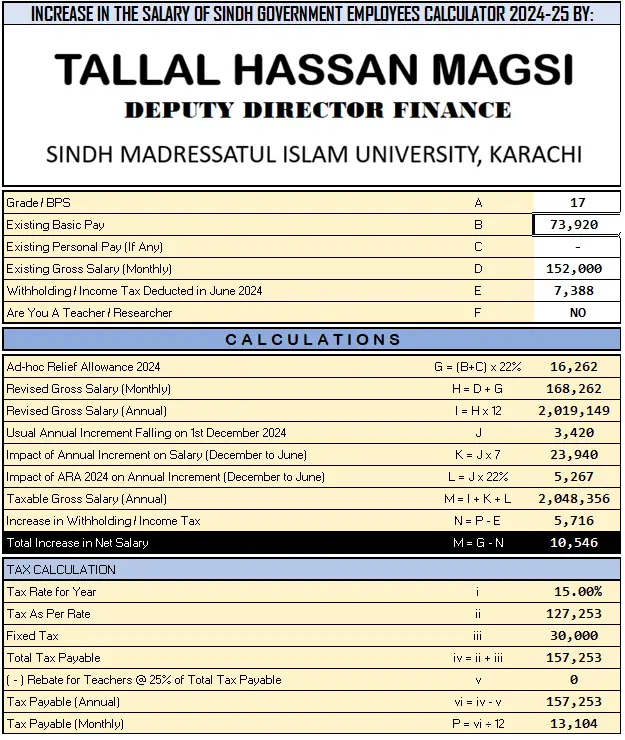

the Salary Increase Calculator for 2024-25 announced by the Government of Sindh. It includes the salary increase due to the Adhoc Relief Allowance 2024 and its impact on Income Tax (Withholding Tax) based on the new slabs introduced by the Federal Government (FBR) through the Finance Bill 2024 and its amendment. Here are the details:

Salary Increase Calculator 2024-25 for Sindh Government Employees

These calculations are based on a Government of Sindh employee’s status as of June 30, 2024. You can use this calculator to estimate the total increase in gross salary, income tax, and net (take-home) salary, keeping other factors constant. Enter the following information as of June 2024:

- Grade / BPS

- Existing Basic Pay

- Existing Personal Pay (if any)

- Existing Gross Salary (Monthly)

- Withholding / Income Tax Deducted in June 2024

- Are You a Teacher / Researcher?

Automatic Calculations

The calculator will automatically compute the following:

- Increase in Salary with 30% / 25% / 22% Adhoc Relief Allowance 2024

- Revised Gross Salary (Monthly)

- Taxable Gross Salary (Annual 2024-25)

- Tax Payable (Annual 2024-25)

- Tax Payable (Monthly)

- Increase in Withholding / Income Tax (June 2024 vs. July 2024)

- Detailed calculation of the Withholding / Income Tax as per revised slabs

Special thanks to Mr. Tallal Hassan Magsi, Deputy Director Finance, Sindh Madressatul Islam University, Karachi, for his contribution.