Passion in Ethereum’s Price Movement: Investors are preparing for a potential surge in investment activity as Ethereum approaches a price threshold of over $4,000 before the upcoming upgrade.

Passion in Ethereum’s Price Movement: A standout in the industry, Ethereum’s smart contracts system, along with its ability to empower various decentralized applications, is driving its price to new heights. Just as Bitcoin reached a temporary high of $72,710 on March 11th, Ethereum’s value surpassed $4,000 for the first time since December 2021.

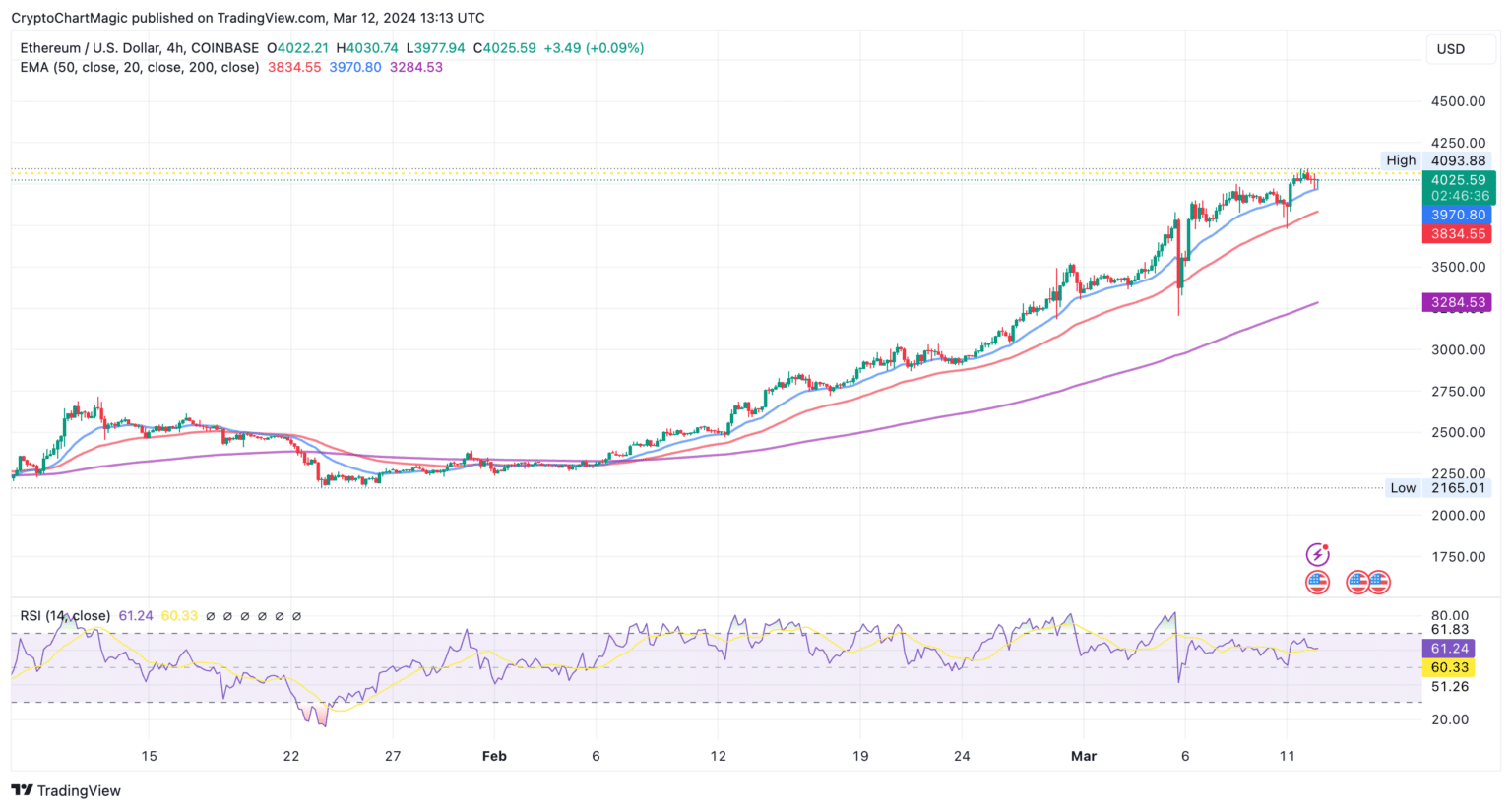

With Ethereum’s price hovering around $4,030, investors are hopeful for new temporary highs this week. Supporting the price above $4,000 will provide positive sentiment and backing for future protocol upgrades and advancements.

Despite prevailing market sentiments, several unique factors are bolstering Ethereum’s outlook. This analysis will delve into significant market movers and anchors, particularly in the DeFi sector.

Dencun Upgrade

What is the Dencun upgrade?

The Dencun upgrade, also known as a “hard fork,” introduces significant changes to Ethereum’s consensus rules and operational aspects.

Specifically, it incorporates ephemeral data blobs (protocol enhancements) through EIP-4844, aimed at reducing layer 2 transaction fees.

Why is this significant?

Dencun enhances scalability and efficiency, crucial for Ethereum’s progress.

It follows last year’s Shapella upgrade and aligns with Ethereum’s continuous development trajectory.

Key features include:

- Ephemeral data blobs: Improving transaction processing efficiency.

- Easier storage upgrades, particularly beneficial for layer 2 scaling solutions.

- Dencun’s long-term impact on Ethereum strengthens its foundational principles, making the protocol more attractive to developers and users. Expectations for improved network performance can positively influence Ethereum’s valuation.

In summary, Dencun signifies a milestone in Ethereum’s journey, solidifying its position as a leading blockchain platform. For investors, this upgrade signals long-term growth potential and clarifies Ethereum’s relevance in the crypto space.

Now that Ethereum has surpassed $4,000, those understanding the significance of the Dencun upgrade anticipate the next breakout towards $5,000—a new all-time high.

Market Sentiment and FOMO

The crypto market maintained strong momentum from Q4 of the previous year. Increasing interest in cryptocurrencies surged, especially after the fulfillment of the long-awaited Bitcoin ETF dream in the United States.

Bitcoin’s new all-time high propelled the entire market forward. Altcoins, under Ethereum’s leadership, reached new highs, following Bitcoin’s footsteps.

The upcoming halving of Bitcoin in April may further fuel excitement, leading to a notable decrease in supply and continued demand. Due to the relationship between BTC and ETH, a rapid rise in Bitcoin often translates to a parabolic rally in Ethereum’s value.

Spot ETH ETF

The notable performance of Bitcoin ETFs has prompted market participants to speculate about potential effects of a viable Ethereum ETF on Ethereum’s price in the long term.

Several applications are already with the Securities and Exchange Commission (SEC), including BlackRock’s. However, approval is uncertain, particularly due to regulators’ cautious approach towards Ethereum’s status—whether it qualifies as a security or not.

If approval for Ethereum’s inclusion in investment products is granted, it could accelerate Ethereum’s growth, similar to Bitcoin ETFs. Increased demand alongside stable or diminishing supply could propel Ethereum beyond $10,000.

Also Read: Shiba Inu Coin Price Prediction: Technical Analyses – Shib Price $0.00014 Soon…

Ethereum’s Price Movement: Navigating Market Momentum

With Ethereum maintaining levels above $4,000, it immediately responds after hitting $4,085. Traders anticipate continuous bullish momentum, awaiting candle closures above $4,000 for several consecutive hours.

If Ethereum dips below $4,000, investors might consider dollar-cost averaging from the 20-day EMA to the 50-day EMA (indicated by blue and red lines on the chart) to maximize profits.

A bearish divergence in the Relative Strength Index (RSI) heading towards the median (50) indicates a diminishing bullish momentum. Thus, to clear lower regions below $4,000 and secure liquidity before the next significant move towards $5,000, Ethereum might undergo a consolidation phase.